Grow Rich with the Property Cycle – a catchy title for an article that’s a description of our property cycle(s) on the Texas coast.

So, When Is the Best Time to Invest in Real Estate?

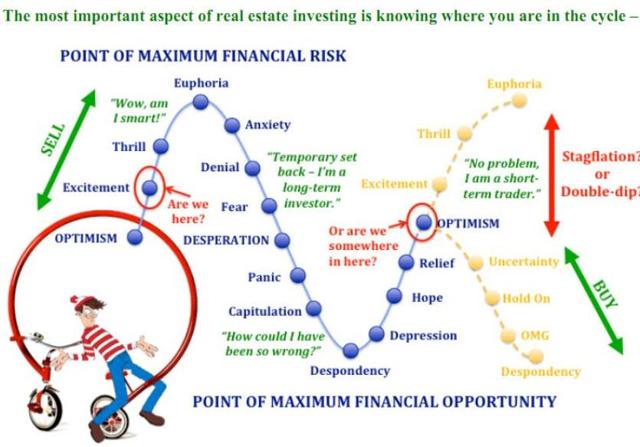

Given the circumstances, during a recovery phase might be the best time to invest in real estate. Why? You can reap the benefits of below market value prices in an economy that is about to explode with high rental rates and a great occupancy rate.

It is important to understand that, depending on your goals, you might be better off buying at a different phase. For instance, if you want the absolute cheapest price, buying during a recession would be best. Or, if you want immediate, excellent cash flow and you can afford to pay a little extra for your investment property, buying during the expansion phase is right for you.

The Duration and Frequency of the Real Estate Cycle

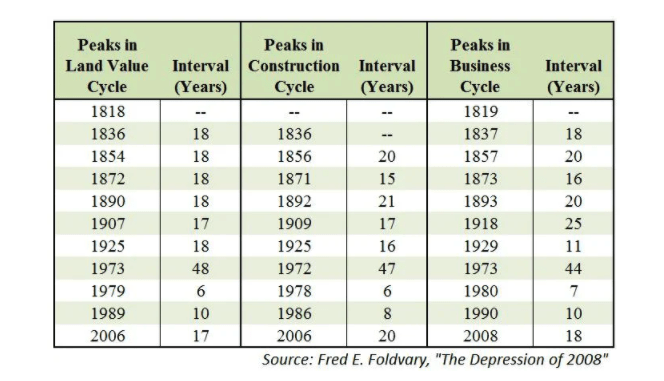

The most stunning aspect of the real estate cycle is not its inevitability but rather its regularity. Economist Homer Hoyt, through a detailed study of the Chicago and broader US real estate markets, found that the real estate cycle has run its course according to a steady 18-year rhythm since 1800. That puts us right on time for 2024!

When it comes to real estate, if your finances support it, there is never truly a bad time to invest. If you make informed investment decisions based on real estate data and analysis, you can never go wrong.

Texas A&M Real Estate Center Articles on Housing Cycles

Interesting Real Estate Cycle Articles

- Harvard.edu/blog/how-to-use-real-estate-trends-to-predict-the-next-housing-bubble

“Those who study the financial crisis of 2008 will (we hope) always be weary of the next major crash. If George, Harrison, and Foldvary are right, however, that won’t happen until after the next peak around 2024.” – published 2016 - Mashvisor.com/blog/housing-market-cycle-when-to-buy

“buy rental properties with a down payment that you can keep for years and aim for properties that generate enough cash flow to pay off their own monthly mortgage payments”